Simplify payment ops with a next-generation finance platform

Our all-in-one dashboard enables cheaper cross-border transactions at up to real-time speeds.

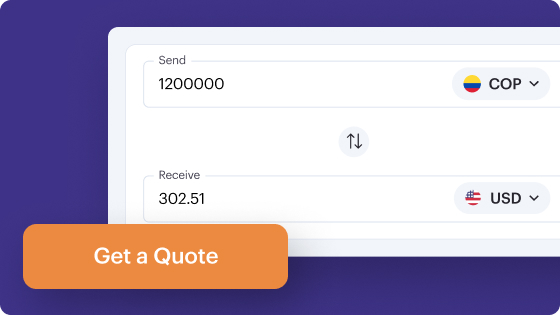

Get a live quote in seconds

Make faster, cheaper global payments with one dashboard

Reliable, transparent money movement

The Conduit team and platform puts reliability first to keep your payment ops running smooth.

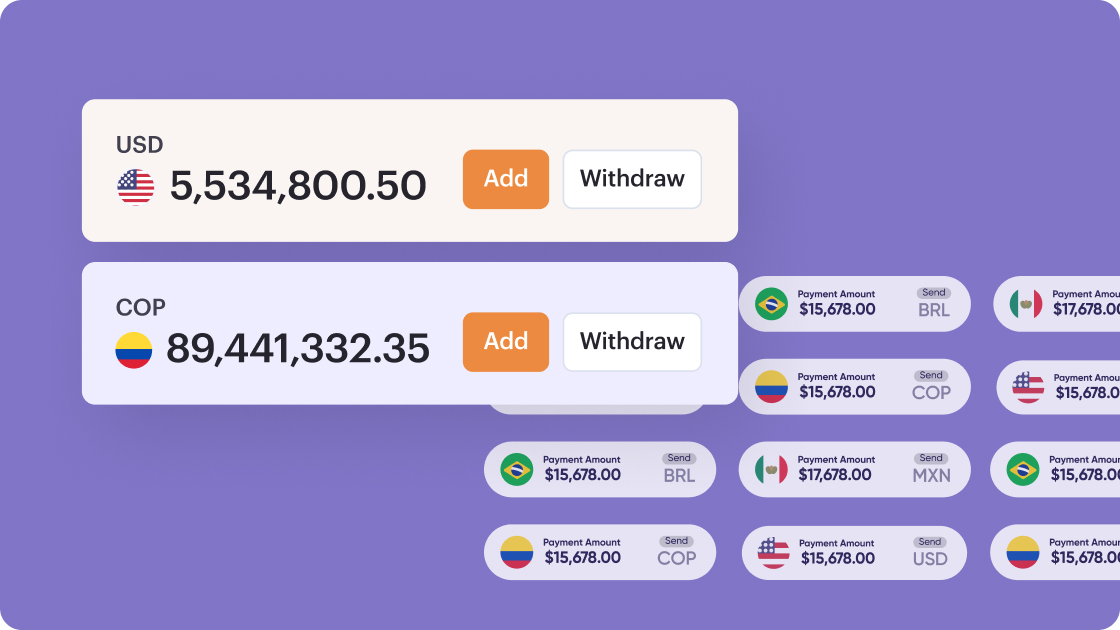

Faster global accounts payable

Our payment network allows for USD, MXN, COP and BRL payments to global destinations, as fast as real-time.

A simplified experience for your team

Add recipients, assign permissions, get live quotes, and manage receipts from one easy-to-use platform.

Lower FX costs

We design customized flow of funds for clients to make transfers up to 22% cheaper than traditional alternatives.

How it Works

01

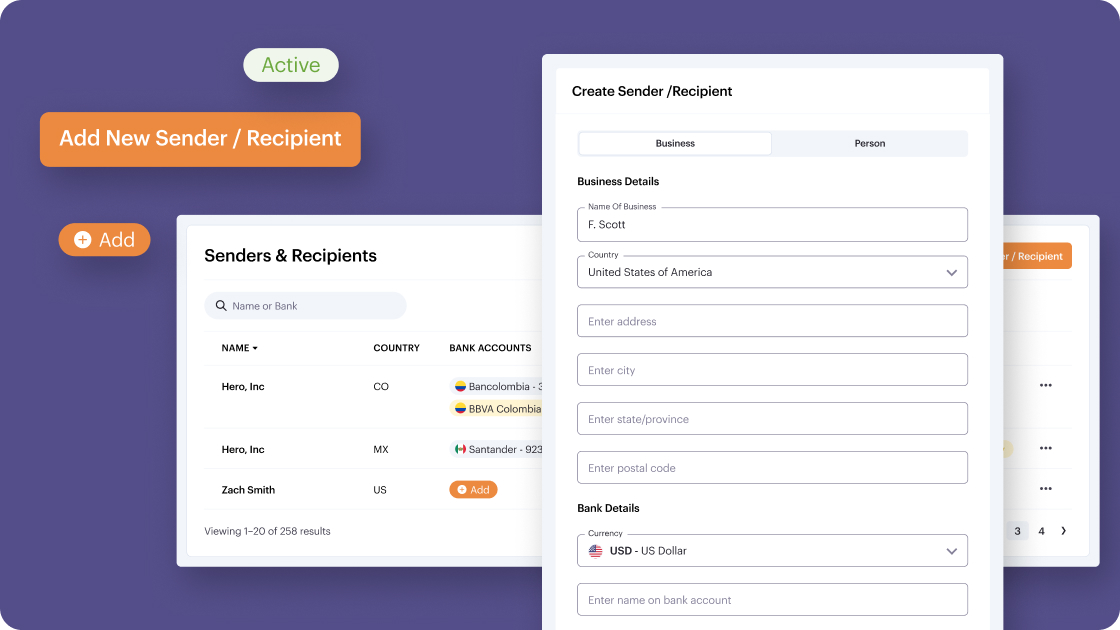

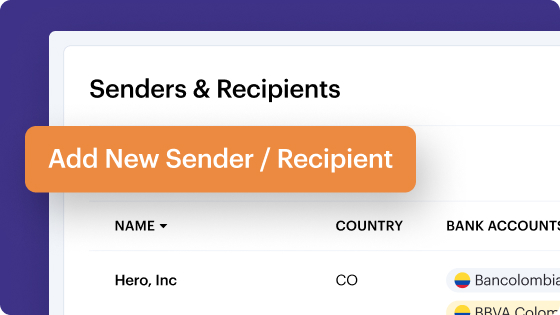

Add your recipient

Easily add your destination for funds – such as a service provider, remote employee, or internal treasury.

Save your recipient for fast future payouts!

02

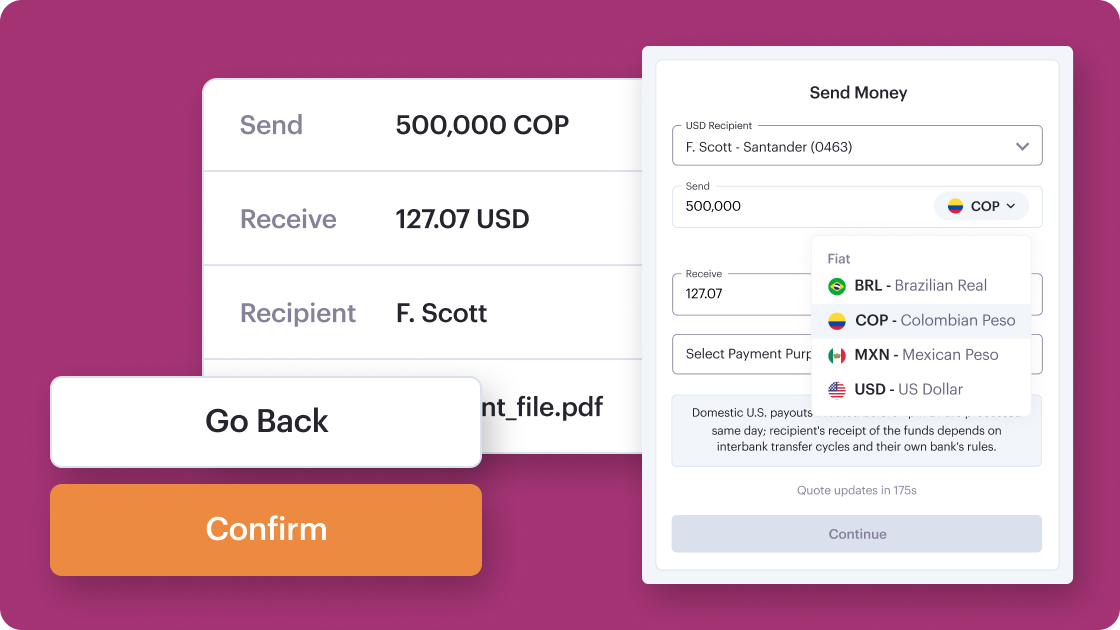

Lock in your quote

Our payment network generates highly competitive live quotes, so your global payments are cheaper.

03

Confirm your details

When you’re ready to send payment, sit back and let the Conduit platform do the rest.

Payments arrive as fast as real time, based on currency and destination.

04

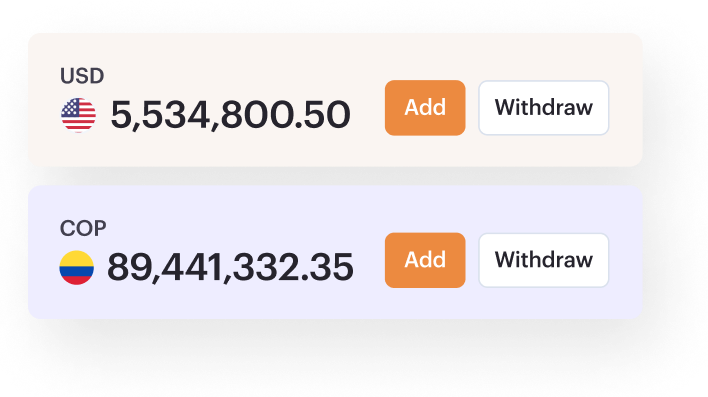

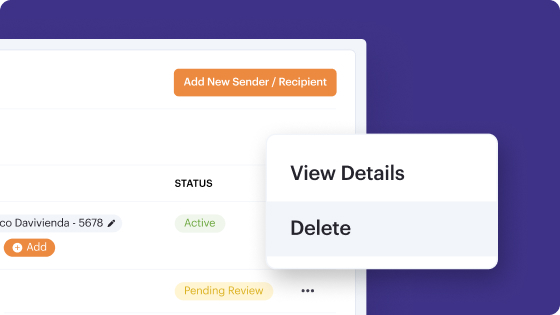

Manage your transactions

Add your team members to keep track of transactions and manage receipts.

Local options for global payments

Fund your transfers with the same payment rails you are used to

| Country | Payment methods |

|---|---|

Brazil |         |

Chile |          |

Colombia |        |

Mexico |        |

Peru |          |

USA |    |

Build products your users will love

Our end-to-end platform reduces development complexity, so you can focus on user experience

.png)